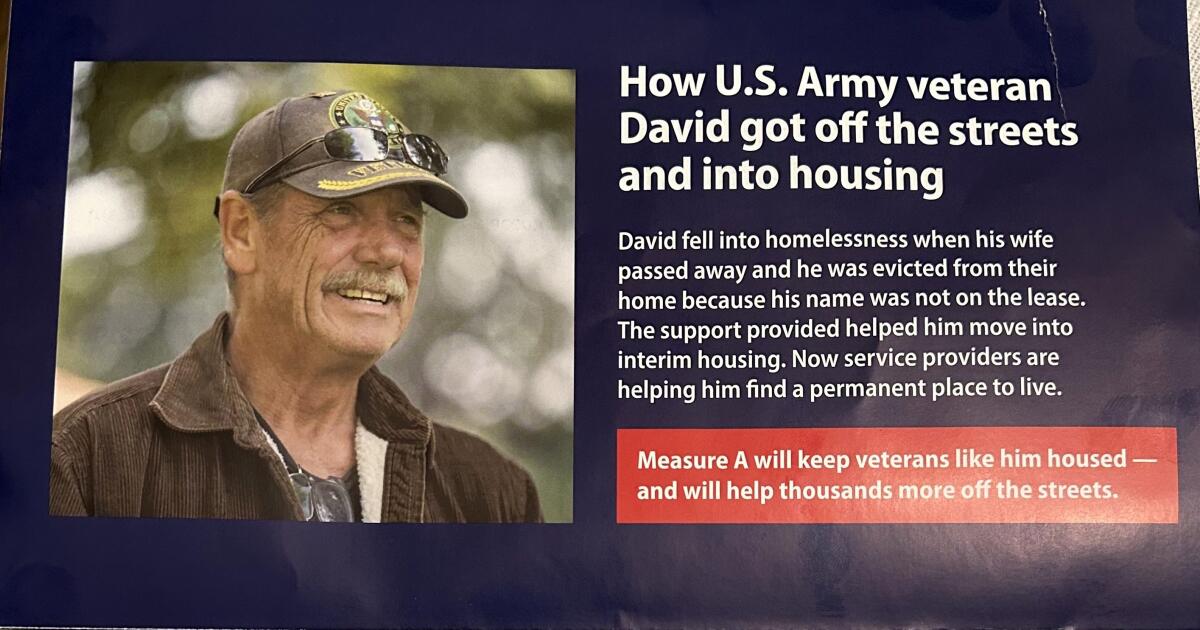

A campaign flier arriving in mailboxes around Los Angeles County promotes a ballot measure that would mandate “a new approach to expand programs that are proven to prevent homelessness and increase housing affordability.”

The measure, which will appear on the November ballot, would “repeal the existing approach,” it says.

What it doesn’t say is that the measure is a tax and that it would double the quarter-cent sales tax that funds the existing approach.

Measure A, which requires a simple majority for passage, would repeal the quarter-cent sales tax voters approved in 2017, two years ahead of its mandatory expiration in 2027, and replace it with a half-cent sales tax that would remain in effect indefinitely, unless repealed by voters.

The tax, estimated to raise more than $1 billion annually, would fund homelessness programs, including mental health care, affordable housing, rental subsidies, and services.

Sixty percent of the money would go to the county for homeless services and prevention including subsidized housing and shelter, mental health care, case management, employment services and acquisition of existing housing.

Another 35.75% would go to the newly formed Los Angeles County Affordable Housing Solutions Agency for construction of new housing, preservation of affordable housing and tenant protections.

The flier states that L.A. County officials estimate that homelessness would increase at least 25% if the previous tax were to expire without a replacement. Even so, it says, the prior measure “does not sufficiently fund either homelessness prevention or affordable housing—key lessons learned that are reflected in Measure A.”

As long as the proper disclosures are included identifying who is behind the mailer, there is no requirement to provide all relevant information, said Sean McMorris, transparency, ethics and accountability program manager for the watchdog group California Common Cause. That is a requirement, though, for the description included in sample ballots mailed to all voters.

“That’s just kind of typical political strategy: Avoid negative aspects, and focus on the positive aspects or the talking points that will be most appealing or less controversial to the public,” McMorris said. “If that means not mentioning this is an actual tax, then it is left to the voters to do their own research or to read the ballot description, or for the press to inform them.”

The flier indicates it was sponsored by United Way of Greater Los Angeles, Habitat for Humanity Greater Los Angeles and PATH, or People Assisting the Homeless.

Tommy Newman, United Way’s vice president for public affairs and activation, said the groups sent it independently of the Measure A campaign.

“This is not a campaign piece of mail,” Newman said. “It doesn’t say vote yes. It offers facts about the measure. You only get so much space in these pieces and you try to tell the story about what the measure will do.”

Newman said it’s one of several mailings that will go out as the campaign gears up and others will include information on the tax source.

The flier, which went to a million households, has a link to a website created by United Way that goes into more detail, including an analysis of the cost. It estimates the sales tax would cost $5 per month for an average household and $13 a month for a high-income household. It gives an example of the added cost of 25 cents for a $100 tennis racket or necklace.

If adopted, Measure A would add a quarter-cent to the sales tax in most cities and unincorporated areas. But in six cities the tax will increase a half-cent because their sales tax rates were at the maximum when the earlier measure went into effect. A recent change in state law has allowed their rates to increase.

The Howard Jarvis Taxpayers Assn., which wrote the opposition statement that will appear on the ballot, considers the measure a special interest tax put on the ballot by groups that will benefit from it, said Susan Shelley, vice president for communications.

The measure, which qualified for the ballot through a signature campaign, requires only a simple majority for passage under court rulings that the voter-approved requirement of two-thirds majority for tax increases imposed by government does not apply to citizen initiatives.

“Raising the sales tax and taking the temporary tax and making it permanent and doing it with a citizens initiative, we think it’s outrageous,” Shelly said.

The Jarvis association has not decided how much it will put into an opposition campaign, Shelly said.

Newman said the pro-campaign is focused on the major new elements of Measure A — increased funds for housing, homelessness prevention and accountability — than the cost.

“In the research the campaign has done, the primary concerns voters have are not about the sales tax increase,” Newman said. “The primary concerns they are how this money is going to be spent, what is it different than what we were doing before and what will the results be.”

The measure requires oversight by a new board called the Leadership Table, made up of city and county officials and community representatives. Prior to the election, the group will create a draft of specific metrics for each of five goals: increase the number of people moving from encampments, reduce the number of homeless people with mental illness and/or substance use disorder, increase the number of people permanently leaving homelessness, prevent people from becoming homeless and increase the number of affordable housing units.

Funds would be shifted from programs that fail to meet those goals.

Campaign finance records filed with the Los Angeles County Registrar-Recorder show two committees behind the measure have raised just under $4 million, with United Way contributing $1,580,000.